Buying prescription drugs shouldn’t feel like playing a guessing game. One pharmacy charges $400 for your monthly medication. Another down the street asks for $85. Same pill. Same dosage. Same insurance. What’s going on? The truth is, drug costs vary wildly-sometimes by more than 500%-depending on where you fill your prescription. And without the right tools, you’re left paying more than you should.

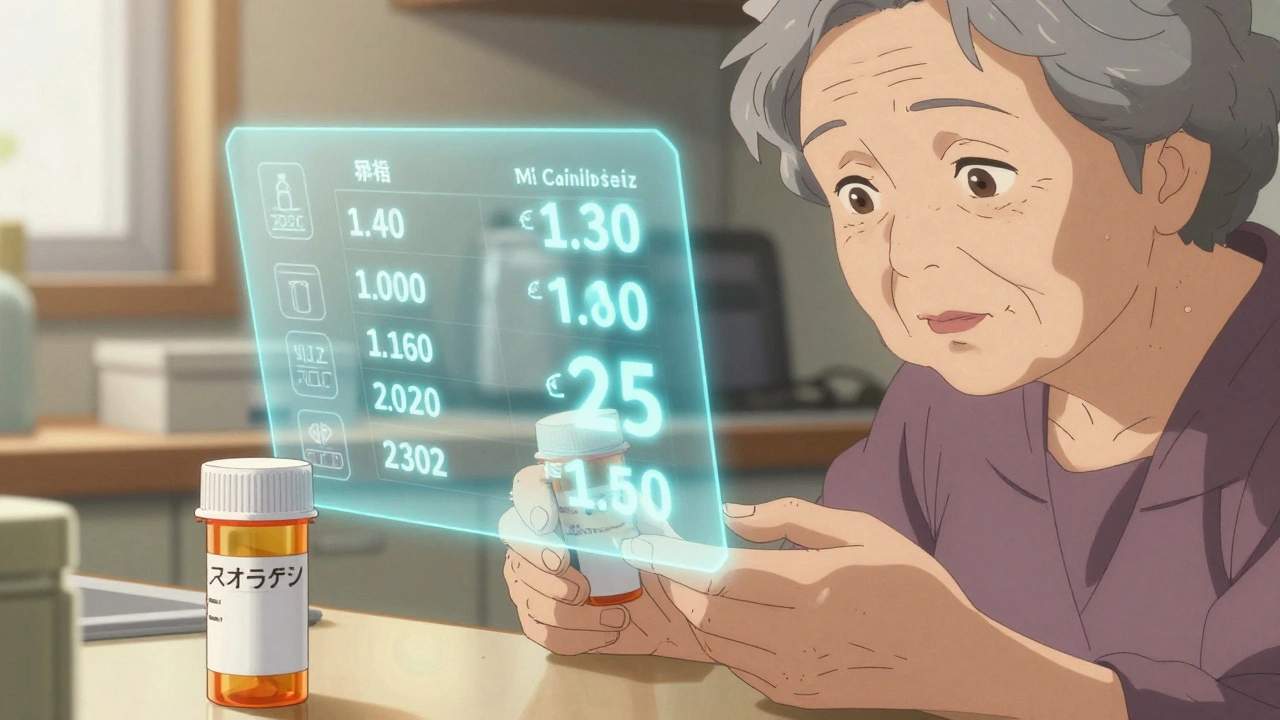

Thankfully, price transparency tools are here to change that. These free, online platforms let you compare real out-of-pocket prices for your medications across nearby pharmacies, see cheaper alternatives, and even find discounts your insurance might not tell you about. They’re not magic, but they’re powerful-if you know how to use them right.

Why Drug Prices Are So Unpredictable

You might think the price of a drug is set by the manufacturer. It’s not. The list price you see on a drug label is just the starting point. What you actually pay depends on your insurance plan, the pharmacy’s negotiated rate, whether you’ve met your deductible, and even the time of year. Two people with the same insurance can pay completely different amounts for the same drug if they use different pharmacies.

For example, a 30-day supply of apixaban (a blood thinner) might cost $520 at one pharmacy, $180 at another, and just $45 if you use a coupon or switch to a generic. That’s not a typo. A 2023 study found that 83% of people using price comparison tools found at least one lower-cost option for their meds.

The reason? Pharmacy benefit managers (PBMs) negotiate secret deals with drugmakers and pharmacies. These deals aren’t public. Without tools to reveal them, you’re flying blind.

What Price Transparency Tools Actually Show

These tools don’t just show list prices-they show what you’ll pay right now, with your insurance. They pull data directly from your insurer’s network, so the numbers are accurate for your plan. Most tools also include:

- Real-time pricing from pharmacies within 10 miles

- Cost comparisons between brand-name and generic versions

- Suggestions for alternative medications that work the same but cost less

- Information on coupons, patient assistance programs, and mail-order options

Some tools go further. Rx Savings Solutions, for instance, can automatically suggest a cheaper drug your doctor might approve. In one case, a user saved $287 on a 90-day supply of apixaban just by switching to a generic alternative the tool recommended. That’s more than $90 a month-enough to cover groceries or gas.

Healthcare Bluebook helps with procedures like MRIs or lab tests, showing you which facilities charge the least. Turquoise Health gives you access to pricing data from hospitals and insurers, letting you filter by location, insurance, and service type. FAIR Health offers a free public portal that doesn’t require you to log into your insurance account at all.

How to Use These Tools-Step by Step

Using a price transparency tool is simple. Here’s how to get the most out of it:

- Check if your insurer offers one. About 78% of large employers now include a built-in price tool. Log into your insurance website or app and look for "Drug Cost Estimator," "Price Comparison," or "Optum Rx" (common for plans like Aetna, UnitedHealthcare, and Blue Cross).

- Enter your exact medication. Type in the name, dosage (like 10mg), and quantity (30-day, 90-day). Be precise-"metformin 500mg" isn’t the same as "metformin 850mg."

- Compare prices across pharmacies. The tool will show you nearby options. Look for the lowest out-of-pocket cost, not the lowest list price. Sometimes the cheapest option is a mail-order pharmacy or a Walmart or Costco pharmacy.

- Check for alternatives. Many tools suggest cheaper drugs that treat the same condition. Ask your doctor if switching is safe. For example, lisinopril is often a cheaper alternative to more expensive blood pressure drugs like losartan.

- Verify before you pick up. Call the pharmacy and ask: "If I pay cash today, what’s my total with my insurance?" Sometimes the tool’s estimate is off because of a delay in insurance updates. Don’t assume it’s perfect.

Most people take 15-20 minutes the first time. After three uses, it takes under 7 minutes. That’s less time than waiting in line at the pharmacy.

Top Tools to Try Right Now

Not all tools are created equal. Here are the most reliable ones based on user feedback and expert ratings:

| Tool | Best For | Requires Insurance Login? | Alternative Drug Suggestions | User Rating (out of 5) |

|---|---|---|---|---|

| Rx Savings Solutions | Pharmacy cost savings | Yes (via employer/insurer) | Yes, automatic | 4.6 |

| Optum Rx (myCompass) | UnitedHealthcare, Aetna, and other major plans | Yes | Yes | 4.3 |

| Healthcare Bluebook | Procedures, imaging, labs | No | No | 4.5 |

| FAIR Health Consumer | Anyone without insurance login | No | Yes | 4.2 |

| Turquoise Health | Advanced users, detailed data | Yes | Yes | 4.1 |

Rx Savings Solutions is the most effective for prescriptions, according to the Commonwealth Fund. If your employer doesn’t offer it, try FAIR Health-it works for anyone, even if you’re uninsured.

What These Tools Won’t Tell You

They’re not perfect. Here are the big gaps:

- They don’t always include GoodRx or SingleCare coupons. A 2023 Consumer Reports review found that 30% of tools missed these discounts. Always check GoodRx separately.

- Specialty drugs are often excluded. If you’re on a biologic for rheumatoid arthritis or a rare cancer drug, these tools may not have data.

- Some tools show list prices, not your actual cost. Watch for phrases like "retail price" or "manufacturer price." You want "your cost with insurance."

- Insurance delays can mess up estimates. If you just changed plans or met your deductible, the tool might be off by a few days.

That’s why you always need to call the pharmacy before picking up your prescription. The tool gives you a starting point-not the final word.

Real People, Real Savings

People are using these tools to cut their drug bills in half.

One user on Reddit saved $1,230 a year by switching from a brand-name statin to a generic, found through Optum Rx. Another found their $4,200 MRI bill could drop to $450 by going to a different imaging center-using Healthcare Bluebook. A 68-year-old in Florida cut her monthly insulin cost from $320 to $35 by switching to a lower-tier pharmacy and using a manufacturer coupon the tool flagged.

These aren’t rare cases. A 2023 National Bureau of Economic Research study showed that in states with strong transparency laws, outpatient drug costs dropped 4.7% per year. That’s not a trickle-it’s a flood of savings.

What’s Coming Next

The government is pushing for more transparency. By 2025, all tools must include quality ratings alongside prices-so you can see not just what something costs, but how good the service is. AI is starting to predict your future drug costs based on your usage patterns. And a new group called the Alliance for Transparent Drug Pricing, formed in May 2024, includes UnitedHealthcare and Express Scripts. They’re working to standardize how prices are shown so you’re not confused by different formats across apps.

By 2026, the Congressional Budget Office predicts 90% of people will use a price tool before buying a prescription. That’s not a guess-it’s inevitable. The money’s too big to ignore.

Start Today-Your Wallet Will Thank You

You don’t need to be a tech expert. You don’t need to call 10 pharmacies. You just need to open one tool, type in your drug, and click "compare."

It takes five minutes. The savings? Hundreds, sometimes thousands, of dollars a year. That’s not a luxury-it’s a necessity. With drug prices still rising faster than wages, using these tools isn’t optional. It’s how you protect your health and your budget at the same time.

Don’t wait until your next refill. Open your insurance app right now. Look for the price tool. Type in your medication. See what you’re really paying. And then, if you can save money-do it.

Do price transparency tools work for uninsured people?

Yes. Tools like FAIR Health and GoodRx let you see cash prices without needing insurance. Many pharmacies also offer discount programs for cash-paying patients, especially for common medications like metformin, lisinopril, or atorvastatin. These tools show you what you’d pay out-of-pocket, even if you have no coverage.

Why does my pharmacy charge more than the tool says?

There are a few reasons. Insurance updates can take 24-48 hours to reflect in the tool. Some tools don’t include pharmacy-specific coupons like GoodRx. Also, if you’re still in your deductible phase, the tool might show your estimated cost after the deductible, but you haven’t met it yet. Always call the pharmacy to confirm before picking up your prescription.

Can I use these tools for my elderly parents?

Absolutely. Many seniors pay hundreds a month for multiple prescriptions. Tools like Optum Rx and Rx Savings Solutions are designed for people on Medicare Part D. You can enter their medications, compare pharmacies, and even find low-cost alternatives. Some tools even let you set up alerts for price drops on their meds.

Are generic drugs as good as brand-name ones?

Yes. The FDA requires generics to have the same active ingredients, strength, dosage, and effectiveness as brand-name drugs. The only differences are in inactive ingredients like fillers or coatings, which rarely affect how the drug works. In 80% of cases, switching to a generic saves 80% or more without any loss in effectiveness.

What if my doctor won’t switch me to a cheaper drug?

Ask them why. Sometimes it’s just habit. Bring the tool’s recommendation to your appointment. Say: "This tool says there’s a generic that works the same and costs $40 less a month. Is that safe for me?" Most doctors are open to it-especially if it’s backed by data. If they say no, ask for a second opinion or request a prior authorization form to get the cheaper option covered.

Write a comment

Your email address will not be published.

13 Comments

This is literally life-changing info. I paid $300 for my blood pressure med last month. Just checked Optum Rx-same thing for $45 at Walmart. 🤯

I’m Canadian, and I’ve never understood how Americans pay this much for pills... but thank you for detailing the tools. I’ll share this with my sister in Texas. She’s on insulin and can’t afford it.

Most people don’t know that GoodRx often beats insurance. Always check it first. And if you’re on Medicare, don’t forget the Part D Low-Income Subsidy-some folks get their meds for $0. Just ask your pharmacist.

So... you're telling me I've been overpaying for my antidepressants for three years because I didn't Google it?

I used FAIR Health for my dad’s cholesterol med. Saved $180/month. He cried. Not because he was sad-because he finally felt in control. 🥹

In India we pay $2 for the same pill. Why? Because no PBM middlemen. No corporate greed. Just pharmacies selling at cost. You guys need to fix your system-not just your apps.

The tools are useful but the root problem remains systemic. Pharmaceutical monopolies and PBM opacity must be addressed through policy not personal diligence

I’ve used Rx Savings Solutions through my employer. It flagged that my 90-day supply of metformin was $120 at CVS but $18 at Costco with my insurance. I switched. My co-pay went from $40 to $6. I didn’t even know Costco had a pharmacy.

This is just band-aid capitalism. You're telling people to shop around instead of forcing drugmakers to stop price gouging. If you’re proud of saving $90 a month on insulin, you’re part of the problem.

I read this entire thing. You clearly didn’t mention that most of these tools are owned by the same PBMs that are inflating prices. You’re handing people a flashlight in a dark room built by the same people who stole the power.

I love how this post makes it sound like using a website is the moral thing to do. Meanwhile, people who can’t afford to spend 20 minutes comparing prices just... don’t get their meds. 🤡

There’s a deeper question here: why does our society treat healthcare as a commodity rather than a right? Price transparency tools are a symptom of failure-not a solution. We’ve normalized suffering as a personal responsibility.

I tried the tools. They work. But I’m tired of having to be a detective just to afford my prescriptions. My doctor doesn’t even know what my insurance covers. Why should I?